An important update ahead of the 2025 Autumn Budget: Whilst there is always speculation ahead of a Budget that this popular method of paying pension contributions could be curtailed, we are hopeful that Rachel Reeves will not inflict further National Insurance changes on employers and disincentivise pension savings by withdrawing this completely.

Rising costs are continuing to put pressure on organisations, with many looking at potential cost efficiencies in their compensation budgets. One increasingly popular method is implementing salary exchange – also known as salary sacrifice – particularly in relation to pension schemes.

With 49% of employees saying that they would switch roles for one with better benefits [1], it’s more important than ever that companies optimise their offering. Financial worries can have a significant impact on employee wellbeing, with 31% of employees feeling that stresses around long-term finances impacts their workplace productivity [1]. Salary sacrifice is a great place to start for companies looking to optimise costs; this approach not only delivers significant cost savings for employers but also offers tangible benefits to employees, making it a win-win solution.

What is salary exchange?

Salary exchange is a straightforward but effective arrangement where employees agree to reduce their gross salary by the value of their pension contribution. Instead of the employee making the contribution from their post-tax salary, the employer pays the equivalent amount directly into the employee’s pension scheme. This adjustment reduces the gross salary on which both employer and employee National Insurance (NI) contributions are calculated.

Cost savings for companies

The primary benefit for employers lies in the reduction of employer NI contributions. Since the employee’s gross salary is reduced, the employer’s NI liability decreases accordingly.

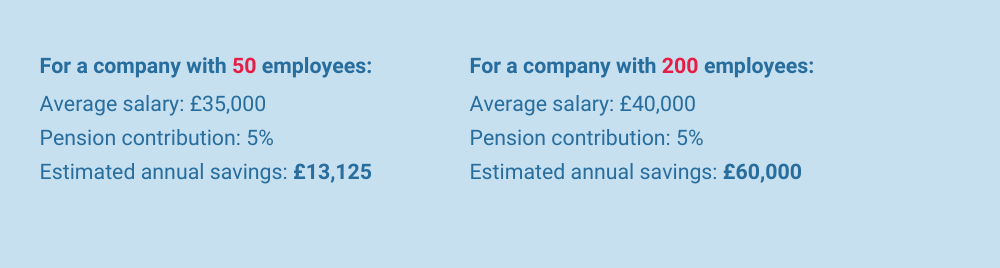

The savings can be substantial – especially in organisations with high levels of employee participation. Savings also increase dramatically with company size.

For example:

These figures demonstrate the significant impact salary exchange can have on a company’s bottom line.

Broader benefits for employers

Beyond direct cost savings, salary exchange enhances the overall employee benefits package. By offering a tax-efficient way to boost pension contributions, companies can demonstrate a genuine commitment to their employees’ financial wellbeing.

This commitment not only helps attract top talent in a competitive recruitment market but also supports staff retention and satisfaction. Employees are more likely to feel valued and supported, which could lead to increased loyalty and productivity.

Additionally, implementing salary exchange is straightforward and can be easily communicated to staff. It positions the company as forward-thinking and responsive to employee needs, further strengthening its reputation as an employer of choice.

Advantages for employees

Employees also benefit from salary exchange – the reduction in their gross salary means they pay less NI, resulting in increased take-home pay without any reduction in their overall reward package. The process is simple for employees to understand and requires minimal effort to participate.

For higher earners, salary exchange offers an added advantage, these employees do not need to reclaim higher or additional rate pension tax relief from HMRC, as the employer’s direct contribution takes care of this automatically – making the process more efficient with a lower administrative burden for employees.

A Tax-efficient, win-win solution

In summary, for companies, salary exchange delivers measurable cost savings and strengthens the employee value proposition. For employees, it increases take-home pay and simplifies pension contributions, all while supporting long-term financial wellbeing.

It is important to note that salary exchange arrangements must comply with current tax and NI legislation. Companies should ensure they communicate the details clearly to employees and seek professional advice to maximise the benefits of the scheme.

When implemented salary exchange is a powerful tool for companies and is set to become a cornerstone of modern employee benefits strategy.

What can companies do next?

- Review your existing pension offering

- Take a multi-channel approach to communicating with employees: you can have a great scheme, but it won’t make impact if employees don’t know about it

- Provide a 1-2-1 or presentation day to help close any gaps in knowledge when it comes to retirement options

- Explore other potential options for implementing salary exchange, beyond pension schemes

[1] Mind the Gap 2024